License Types:

Setting up a company and carrying out any business in UAE requires you to obtain a valid business license. Similarly, to set up a Freezone company in Ras Al Khaimah, you need to obtain a business license in the emirate. Before applying for a business license, however, you need to decide on the activities you will be conducting through your company and the type of structure you need to incorporate – sole establishment, Freezone Limited Liability Company (FZ-LLC) or holding company.

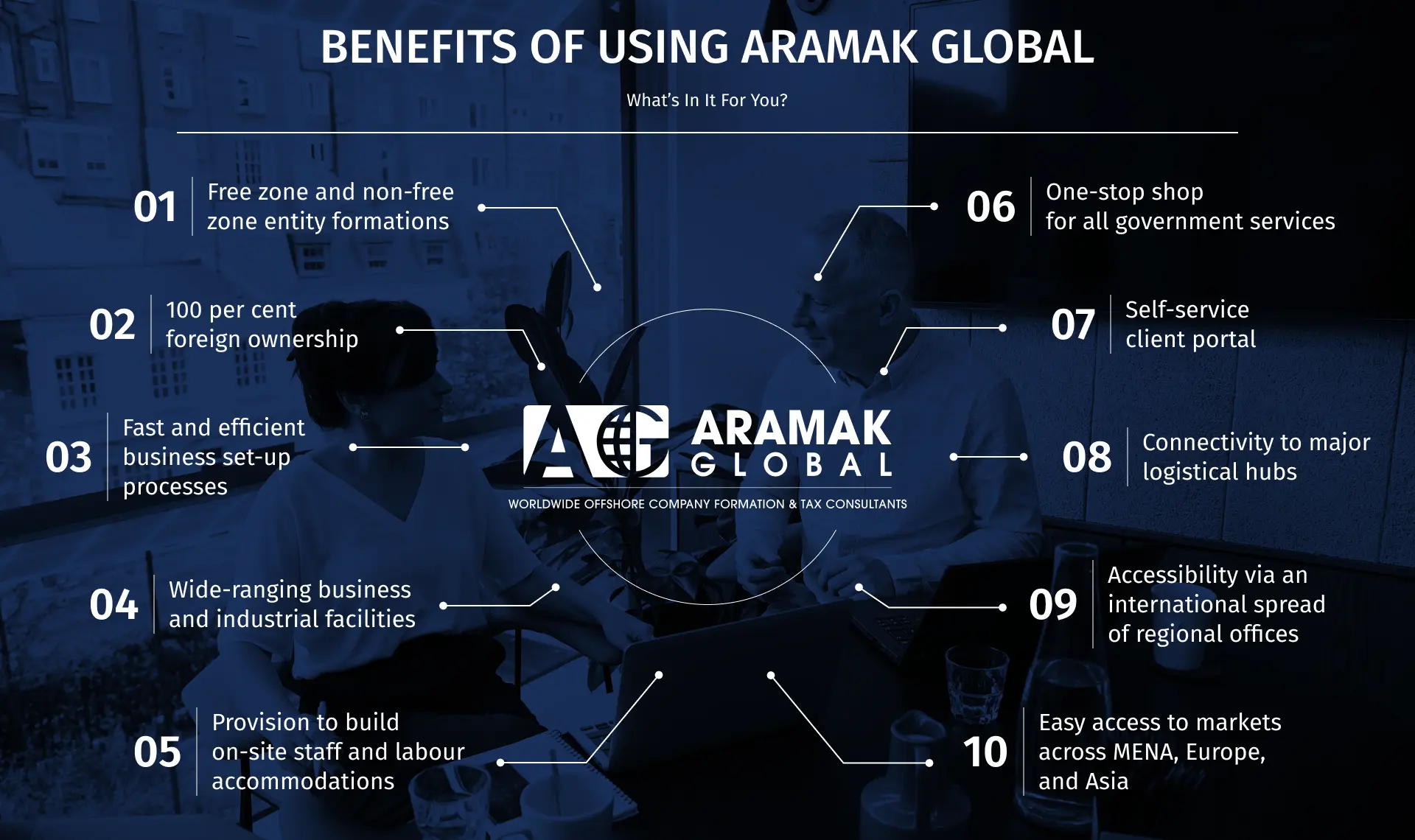

Whether you are a start-up or an established company willing to expand your business in Ras Al Khaimah, or an entrepreneur who wants to diversify your products and services under one entity and operate freely across the country, there are business licenses which allow you to carry out more than one business activity. For instance, the ARAMAK Dual License has the provision to combine commercial and professional activities under one business license. With this, you can seamlessly operate your business in UAE, on the mainland as well as in free zones. The ARAMAK dual business license includes a UAE free zone license as well as a UAE free zone company branch business license.

If you need any support with choosing the right business license, or the business set-up process including compiling and submitting required documents or making payments, the company formation experts at ARAMAK will assist you through the entire journey of obtaining your business license and carrying out your business activities in UAE.

The first thing/step to do is Obtain a Licence in UAE to Form a Company in Freezone for which Corporation Tax is ZERO. Income Tax, Capital Gains Tax, Inheritance Tax are also ZERO.

You must choose what Type of License you require that will be related to what activities you will be performing under your Business.

We offer a wide variety of licence types covering an array of activities:

| Free Zone | Non-Free Zone | ||

|---|---|---|---|

| Trading in services and goods | |||

| Opening An Education-related institution or consultancy company | |||

| Trading in goods and services via electronic means | |||

| Trading in multiple goods | |||

| One Owner with one activity in a specialty or expertise. | |||

| Manufacturing, importing, packaging and exporting products | |||

| Operating media-related business activities | |||

| For individuals who provide professional services | |||

| Conducting services or consultancies across any industry | |||

| For media, education, IT and analysts professionals |

REQUIRED DOCUMENTS CHECKLIST

Finding what documents to prepare can be challenging, but at ARAMAK GLOBAL, we make it easy. Below is the checklist of documents you need based on your business type and legal entity: